Market commentary

-

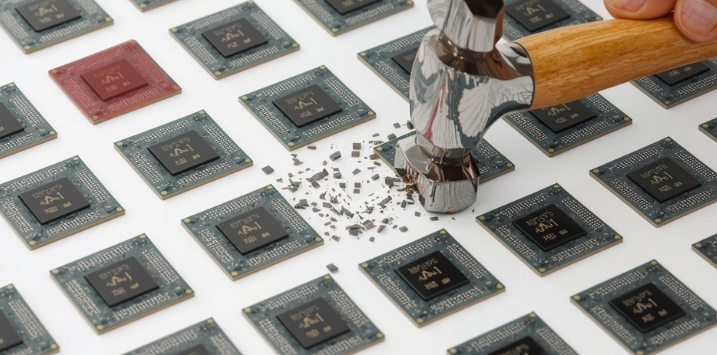

Is the creative destruction phase beginning?

Roger Montgomery

February 6, 2026

Last year, I posted a blog entitled ‘But Nothing’s Changed’, describing how the artificial intelligence (AI) bubble and market boom could end. I explained how investors will realise that even though AI technology – hailed as the 4th Industrial Revolution – will change the course of human history, it probably won’t do so tomorrow. And therefore, share prices were at risk of setbacks because there will be commercial bumps (delays in data centre builds, changes in interest rates, shortages of energy and water, and not all companies can win) along the way to an AI ‘utopia’. While timing a change in sentiment is impossible, the hype surrounding general-purpose technologies, including AI, makes such a change inevitable. It’s always been so. continue…

by Roger Montgomery Posted in Manufacturing, Market commentary, Technology & Telecommunications.

-

Decoys and lame ducks – why EV incentives miss the emissions problem

Roger Montgomery

February 6, 2026

Having returned to work after a little rest and respite, I was recently confronted, nay, berated, by headlines about Labor’s deal to slash borrowing costs for electric vehicles (EVs) as it scrambles to meet climate targets.

While I was away, I saw the chart in Figure 1 and immediately realised the futility of our efforts to influence the global climate, concluding that Labor’s schemes appear to be driven by ideology rather than evidence. continue…

by Roger Montgomery Posted in Energy / Resources, Manufacturing, Market commentary.

-

MEDIA

ABC Statewide Drive – market volatility signals a shift in thinking

Roger Montgomery

February 6, 2026

On statewide drive with Jess Maguire, I explained that recent market volatility reflects investors reassessing some big assumptions, particularly after Donald Trump’s nomination of Kevin Walsh as the next U.S. Federal Reserve chair.

Many investors had been expecting lower U.S. interest rates, so the nomination caught markets off guard and forced a reversal of those bets. That led to sharp falls in gold and silver, higher bond yields, and weaker share prices. While precious metals may recover over time, I see the bigger influence on sharemarkets as the gradual unwinding of the artificial intelligence (AI) trade. For Australia, stronger U.S. growth can support some companies, but persistent inflation risks and policy uncertainty mean investors are becoming more cautious and re-evaluating risk.

Listen from 1:44:55 here: ABC Statewide Drive. continue…

by Roger Montgomery Posted in Economics, Global markets, Market commentary, Radio.

- save this article

- POSTED IN Economics, Global markets, Market commentary, Radio

-

MEDIA

Soaring stocks hide U.S. fragility as gold surge sends warning to investors

Roger Montgomery

February 5, 2026

The strength of U.S. stock markets would have any reasonable investor believing all is well with the world and that U.S. exceptionalism is alive and well.

Yet, the stock market’s buoyancy belies the head-spinning conga line of events over the first month of 2026 that would, at any other time in history, have caused the market to plunge or coincided with it.

Take gold’s 17 per cent ascent so far this month, which follows a 66 per cent rise in 2025. Such moves are unusual. Since gold began trading freely in the 1970s, the average annual return for gold has been roughly 6-8 per cent. January’s return doubles that annual number.

This article was first published in The Australian on 04 December 2025. continue…

by Roger Montgomery Posted in Aura Group, Digital Asset Funds Management, Economics, Global markets, In the Press, Insightful Insights, Investing Education, Market commentary, Market Valuation.

-

MEDIA

ABC Nightlife – from metals to mega caps: volatility returns to markets

Roger Montgomery

February 4, 2026

-

Not so comfortable in luxury

Roger Montgomery

February 4, 2026

It has struck me as curious that one of the sectors of the global market that was hit after the pandemic lockdowns were lifted but has generally failed to recover, is luxury retail.

I have long believed that many prestige brands, such as Louis Vuitton, Gucci, Prada, and Ralph Lauren, are now so common on street corners and in shopping centres and malls that they verge on being more mass-market than exclusive, more masstige than prestige. One questions how much longer they can sustain their high margins if consumers become unwilling to pay ever-increasing prices for items that can be bought just about anywhere. continue…

by Roger Montgomery Posted in Companies, Global markets, Manufacturing, Market commentary.

-

MEDIA

Fear + Greed Podcast – The bull and bear cases for equities in 2026

Roger Montgomery

February 3, 2026

I joined Sean Aylmer on Fear and Greed to look back at some of the key themes that shaped markets in 2025, including the hype surrounding in artificial intelligence (AI) stocks and the growing case for small caps. We also talked about the rise in gold and silver as the U.S. dollar weakened, and what those moves could signal for investors.

We then looked ahead to 2026, discussing why markets may become more volatile and how diversification into assets uncorrelated to traditional markets could help support portfolios. We covered Digital Asset Funds Management’s Digital Income Fund and how its digital arbitrage strategy aims to benefit from market volatility, and explored how Aura’s Private Credit Income Fund can provide income and returns with no correlation to sharemarkets.

You can listen to the episode on Fear and Greed here: The bull and bear cases for equities in 2026.by Roger Montgomery Posted in Aura Group, Digital Asset Funds Management, Economics, Insightful Insights, Investing Education, Market commentary, Podcast Channel.

-

Playing with fire

Roger Montgomery

February 2, 2026

Interest rates act like gravity on the value of all assets. The lower the rate, the weaker the gravitational force, allowing asset prices to float higher. The Federal Reserve (the Fed) has cut 175 basis points since the current rate-cutting cycle began on September 18, 2024. Since that time, the U.S. stock market, as measured by the S&P500, has risen 22.4 per cent.

As important as interest rates are for asset values, they are perhaps even more important to sentiment, when investors believe they are set based on economic data rather than the whims of politicians – whose own agendas may seek to destroy the benefits of monetary policy when driven by an independent central bank. continue…

by Roger Montgomery Posted in Economics, Market commentary.

- save this article

- POSTED IN Economics, Market commentary

-

MEDIA

ABC Newcastle Mornings – Why 2026 could be a bumpy ride

Roger Montgomery

January 28, 2026

I joined Paul Turton on ABC Newcastle Mornings to talk about why markets are holding near all-time highs despite rising geopolitical tensions, soaring gold and silver prices, and growing uncertainty around inflation and interest rates.

We discussed how mining companies are benefiting from strong commodity prices, why consumer spending remains under pressure from rising living costs, and how banks and other key sectors may respond in a more volatile environment. While no one can predict where markets will head next, 2026 is shaping up to be a bumpier year, with investors rotating away from artificial intelligence (AI) stocks and preparing for greater swings as economic and political risks build.

Tune in from 32:41 to hear the full segment: ABC Newcastle Mornings.

by Roger Montgomery Posted in Economics, Energy / Resources, Global markets, Market commentary, Radio.

-

Montgomery Small Companies Fund 2025 year in review

Scott Phillips

January 27, 2026

2025 was a strong year for small companies and for the Montgomery Small Companies Fund. In this detailed video, I’m joined by Gary Rollo, Co-Portfolio Manager of the Montgomery Small Companies Fund to review the Fund’s performance, key market drivers, and the outlook for small caps and growth companies heading into 2026. continue…

by Scott Phillips Posted in Companies, Economics, Global markets, Investing Education, Market commentary, Market Valuation, Small Caps, Stocks We Like.